Financing

La Balma Housing Cooperative, Barcelona

Introduction

The financing of cooperative housing or any community housing has become more and more of a challenge over recent decades. The reasons for this relate both to housing market economics and how willing governments are to support coop housing development as a matter of public policy. The outcome is that it has become more and more difficult to develop coop housing that members can afford to live in.

As a result, coop developers have looked for alternative financing options that help make their coops more affordable. They have achieved much success, helped by lenders who support their mission, including finance cooperatives and by community-led organizations that are able to raise financing, and supportive governments in many cases.

Environmental Scan

Suitable land for housing development is becoming scarcer and scarcer in urban settings. This is resulting in upward pressure on land prices. As well land price is becoming more important than the value of land for non-profit community purposes. The outcome for coop and other community housing development is not a favourable one in a competitive market.

Competing actors for land acquisition

Market developers can outbid community developers because

- they can sell or rent housing at a full market return

- they have access to deep pools of investment capital.

The market is therefore out of equilibrium: financially unequal players are competing for the same assets.

Construction costs

- The cost of materials and labour are growing faster than inflation

- There are stricter building codes and sustainability standards (so more costly)

This all adds up to an affordability crisis in the housing market, both for new buyers and renters. This crisis is growing. New supply alone will not address these problems. Other policy solutions and lending practices are needed.

The Coop Response

Coop housing organizations and policymakers are responding to these challenges in different ways, as financing affordable housing development using only conventional financing is becoming difficult or impossible.

As a result, the challenges of unaffordable financing are giving rise to creative financing solutions.

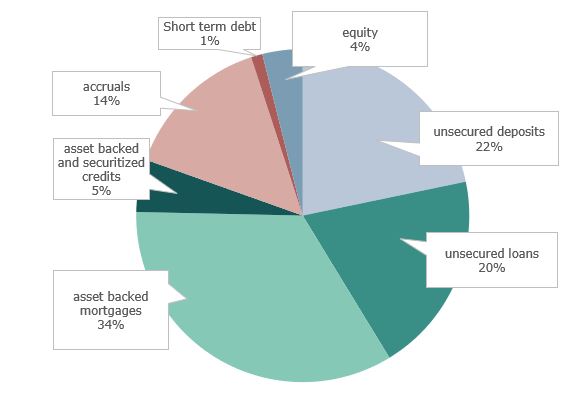

What kind of financing are housing cooperatives using?

Financing for affordable coop development involves the raising of capital funds which must be repaid over time on terms that support affordability goals. Coops in different parts of the world are using a spectrum of financing solutions to achieve this purpose.

The Financing Spectrum

For housing coops financing can come through:

- Debt financing: conventional bank loan

- Public (government) lending

- Social purpose lending

- Patient capital: Patient capital is money a small or medium-sized private business raises. Its name refers to its lenient repayment terms.

- Multiple lenders

- Development grants/subsidies

- Member equity investments (shares)

- Voluntary member contributions

- Collective financing

- Corporate bond market

- Community bonds/shares (Community shares are an effective and democratic way for communities to secure the necessary assets. They are designed so that community members can put their money to work to purchase any income-generating asset needed by the community.)

- Blended financing

- Shared equity models

- Crowdfunding

- Microfinancing

- Revolving loan fund

- Indirect financing support

Who are the actors?

- Coop members

- Coops and secondary coops

- Lenders, conventional, institutional, social purpose

- Community, peer-to-peer investors

- Donors

- Levels of government

- Any or all of these in combination

Palo Alto Housing Cooperative, Mexico City

Sources of Financing

The best financing solutions will often be a combination of different sources. This also creates complex financing models that require expert understanding and implementation.

Debt financing – standard mortgage lending from banks, credit unions, and other financial institutions

- predictable and low underwriting risk, fixed terms, and market interest rates

- interest rates may be lowered if there is a mortgage guarantee (typically a government guarantee)

- on its own, often not an affordable option for community housing development

Public lending – direct lending to housing coops and their developers by a government financial institution, department, or agency

- will typically involve a non-market rate of return

- the purpose is to achieve housing / social policy aims

Social purpose lending – unsecured finance with fewer restrictions than bank finance that connects potential investors with social enterprises to address social problems by funding preventative interventions

- must be able to pay some return to investors

- investors may be willing to accept a below-market return to support coop housing development

- instruments may include social purpose bonds (e.g., sustainability bonds)

- investors may include pension funds and other actors seeking opportunities for impact investing (investing for positive social results)

- overlaps with debt financing (e.g., pension fund lending)

Peer-to-peer lending (coop to coop) – a form of social purpose lending

- through loan stock or community share coops

- involves a direct investment by one coop in another

- can involve share issuance, operational oversight role

Patient capital – longer time horizon for a return on capital provided by social purpose lenders

- the intention is to maximize social impact over a return to investors

- permits deferral of loan repayment until refinancing becomes more affordable

Multiple lenders – two or more sources of financing that complement each other

- may involve a combination of conventional, social purpose and government lending

Development grants and subsidies – can come from government or philanthropic sources, or a combination of the two

- may be in the form of direct assistance or grant-of-use land contributions from various levels of government

Member equity/shares – members purchase shares in the coop

- can significantly reduce coop borrowing requirements depending on the amount of the purchase

- members can save for their share purchases through the housing coop or coop lenders

Voluntary member contributions – members provide donations / unsecured loans to the coop

- assists with liquidity

Collective financing – groups approach lenders together

- offers greater lender business opportunities

- lending risk can be spread among multiple projects

- land trusts with multiple projects are ideal candidates for collective financing

Corporate bond market – A corporate bond is a debt issued by a larger organization for raising capital. An investor who buys a corporate bond is effectively lending money to the organization in return for a series of interest payments

- only available to large-scale providers (e.g., ABZ Sustainability Bond, Zürich); or to intermediary housing finance corporations (e.g., The Housing Finance Corporation, UK; Housing Investment Corporation, Canada)

- long-term lending to providers financed by bond issues from the intermediary

- uses conventional bond market actors to rate and issue the bonds

Community bonds – social-finance instruments that can be used by charities, non-profits, and cooperatives to finance socially and environmentally impactful projects

- beginning to find use in community housing development

- issued on behalf of borrowers by a social-purpose intermediary to investors wishing to invest in an interest-bearing investment with a social-impact purpose

- also known as participatory bonds but not to be confused with standard business participation bonds used for investing in commercial and industrial properties

Blended financing – the use of more than one type of lender to achieve greater debt service capacity

- g., a blend of social purpose / patient capital lending with government or conventional lending

- priority of lender security can be a challenge (see Lending Criteria page for a description of lender priority)

Shared equity models – coop or member has an equity partner, typically a level of government or the coop association itself

- can fit with rent-to-own models

- assists the member by reducing debt service obligations, the member can gradually acquire greater equity over time

Crowdfunding – the practice of funding a project by raising many small amounts of money from many people, via the internet.

Microfinancing – small short-term loans, typically to low-income families in the developing world

- can be used for small-business development purposes or in the case of housing to support the development of a home, typically in stages.

- Also known as microcredit.

Revolving loan fund – a pool of funds available for micro-financing purposes as a gap financing measure primarily used for development and expansion. It is a self-replenishing pool of money, utilizing interest and principal payments on old loans to issue new ones

- borrowers are given small, short-term loans to pay for the construction of a home

- when the loan is repaid it goes back into the loan fund enabling further borrowing

- borrowers can take out successive loans to enable expansion of the home, typically built one room at a time

Indirect financing support – mechanisms that make debt service more affordable

- government financial support that assists with debt repayment

- grant-of-use of government lands held in community land trusts, land-bank foundations with nominal leasing rates

- mixed commercial/residential development (non-residential leasing revenue assists with debt service capacity)

- mixed tenure rental/ownership, sale of ownership units reduce financing costs for rental component

Lending Criteria

Three criteria will typically apply to a loan application, particularly to a market lender application. All three criteria serve to protect lenders from default, or in the event of default, keep the lender whole. Social purpose (impact) lenders can be willing to waive one or more of the criteria, particularly when the amounts at stake for a lender are relatively modest.

Loan to value ratio (LTV) – the amount of the loan relative to the value of the property

- a lender will want the loan to be less than the value by a certain percentage that may vary depending on a lender’s risk tolerance

Debt coverage ratio (DCR) – the ratio of the coop’s debt service (mortgage payment) amounts to a coop’s net operating income (NOI)

- NOI is the net revenue of the coop after operating costs but before debt service and reserve contributions

- a lender will want NOI to exceed debt service obligations by a certain percentage that may vary depending on a lender’s risk tolerance

Mortgage insurance and guarantees – can come from private or government mortgage insurers, government guarantees

- can impact both LTV and DCR by allowing coop to borrow more as these ratios are subject to less risk

Lender priority – refers to the order in which lenders get repaid

- Where there are two or more loans secured on a property, priority refers to the order in which the lenders are entitled to be repaid if the property must be sold.

- The first priority lender will be repaid before the next priority lender(s) receive anything

- Priority is a concern where there are insufficient funds to repay all the lenders in full.

- The lower a lender’s priority is the higher the loan interest rate is likely to be, to compensate for the lender’s additional repayment risk

Financing Framework Profiles

These examples show how financing models have evolved in different countries.

Switzerland

- Predominantly rental coops, some large-scale

- A diversified social lending sector

- Low (or zero) mortgage interest rates

- Lender and government confidence in housing coops

- Mixed-use development

- Some government (guarantee) support

- A large central cooperative model achieves economies of scale

Sihfeld by ABZ, Zurich

Financing tools used

- Coop revolving fund run by Swiss Federation of housing coops; start-up loans @ 1%

- Debt pooling (collective financing)

- ABZ Sustainability Bond

- State loan guarantees

- Coop Sustainability Fund

- Land bank foundation

- Diversified financing – e.g., impact bonds, coop/ethical banks, EU borrowing

- Soliterra Foundation – helps young cooperatives to acquire properties and gives them the right to build on the land

Sweden

- Predominantly ownership coops, mostly moderate-scale

- Small rental coop sector

- A very well-established sector that houses 10% of the population

- Some government (guarantee) support

- A large central secondary cooperative model achieves economies of scale

Hamnkaptenen Housing Coop by HSB, Stockholm

Financing tools used

- Development financing through secondary coop organizations (HSB) and banks

- Finances the purchase partly from members and partly with bank loans

- State loan guarantees reduce the borrowing interest rate

- Member deposits – “tenant-owners” invest 85% of the value (association holds the balance of equity)

- Members save for their deposit/share purchase through the coop

United Kingdom

- Traditionally small/medium scale rental coops

- The sector now includes affordable ownership through mutual home ownership schemes

- A dedicated stream of pre-development funding (Community Housing Fund)

- Some government (grant) support

Financing tools used

- Debt financing/social purpose lending banks, building societies, charitable trusts

- Coop Loan Fund – enabled Student Co-operative Homes to purchase the Birmingham Student Housing Co-operative property in 2014. Find out more in this case study.

- Peer-to-peer lending from loan stock and community shares coops

- Community share issues/offers

- Crowdfunding

- Equity shares purchased by members in mutual homeownership coops – revenue from market “uplift” on coop-held portion of equity (subject to affordability resale formula)

- Government grants

- Combination of these tools

Student Co-op Homes, UK

Canada

- Almost exclusively small/medium scale affordable rental coops

- Land trust landholdings

- Mixed tenure ownership in land trust holdings

- Well-established secondary sector (coop federations)

- Government support

Financing tools used

- Conventional debt financing – banks, credit unions

- Government grants, lending

- Government mortgage insurance

- Grant-of-use of government lands through land trusts

- Patient capital lending, social purpose lender

- Mixed tenure cross-financing

Specific Solution Models

Sostre Civic, Catalonia

- Umbrella group promoting/enabling coop housing development

- Various cooperative housing developments independently managed, funded

- Non-profit affordable resident right-of-use model

- Land right-of-use for 75 years

- Residents /applicants comply with the same criteria for access to public housing

- Right of first refusal over land acquisition

- Government support

- Sostre Civic website

Financing tools used

- Initial payment from members, collaborators

- Private ethical financial institutions

- State-owned finance institute

- Participatory (community) bonds

- State grants

- Donations

La Borda, Barcelona

- La Borda began as a squatters’ site

- The initiative blends a wide range of financing sources

- Relies upon very active member participation

- A good example of combining a wide range of financing sources

- Grant of use model (to residents)

- Government support

La Borda by Sostre Civic, Barcelona

Financing tools used

- Personal member contributions

- Contributory (external) member contributions

- Sale of participatory titles through crowdfunding

- Social purpose (ethical) loans

- Public subsidies including tax forgiveness

- Member participation in the construction

National Cooperative Housing Union (NACHU), Kenya

- Membership organization

- Provides advocacy and technical services to members

- Facilitates

- exit from informal settlements

- entry into first-time ownership

- land title acquisition for members

- Assists members with all aspects of acquisition and development

- Pioneer in housing microfinancing in Kenya

- Began simply as a provider of housing services to the very poor

- Is also engaged in larger-scale development

- National Cooperative Housing Union website

Financing tools used

- Microfinancing loans to individuals, cooperative groups

- Financing offerings include new housing, housing rehabilitation and resettlement loans

- Revolving loan funds, capitalized by international agencies, foundations

- Fund financed by donations (80%) and low-cost loans (20%)

- Loan terms typically 24-72 months

- Loan-to savings ratio applies

- Loans privately insured at low premium

- Loans are double guaranteed by individuals and the coop

- A very low default rate

urbaSEN, Senegal

- Technical support group

- Manages a revolving fund for urban renewal

- Finances the rehabilitation of precarious housing

- Goal: allow access to affordable financing for vulnerable populations

- Organized within the Senegalese Federation of Inhabitants (FSH)

- urbaSEN website

Financing tools used

- Revolving fund for urban renewal

- Fund secured from:

- voluntary individual group savings

- donor funding

- International housing solidarity fund

- The loan goes to the savings group

- Interest rate 5% p.a; interest distribution

- 1% for the member group

- 1% for FSH funds

- 2% for the Revolving Fund

- 1% for urbaSEN

- Loan period: 20 months

- Repayment rate: 84% of loans

MOBA, Central Eastern Europe

(Eastern European cooperative housing membership organization)

- Affordable housing solution for ex soviet-bloc states where all previous social housing was privatized

- Limited equity rental coop model

- Developing a common pool of skills, resources, and tools

- Broad professional support network (e.g. architects, project managers, finance experts)

- Government (EU) support

- MOBA website

Financing tools used

- Membership contributions on entry

- Network collective borrowing

- Access to EU pilot project financing

- Withdrawable shares issue

- Shares investments use as a revolving loan fund

- A pool of fund investors with MOBA as an intermediary

- Crowdfunding and fundraising

COVICOFU, Uruguay

- Mutual-aid housing cooperative (MAHC) to secure land tenure and adequate housing

- Formed secure housing for a poor informal settlement

- Followed 50+ years of struggle to secure land and financing from the government

- Supported by FUCVAM (1970), the Uruguayan Federation of Mutual-Aid Housing Cooperatives

- FUCVAM has defended housing as a right even during the 12-year-long dictatorship

- COVICOFU uses a limited equity rental model

- National government support

- COVICOFU on YouTube

Financing tools used

- Government loans

- Loans based on household income level categories up to a maximum loan amount

- COVICOFU’s members fall into the lowest-income category

- Members make equity contributions through self-construction and earn housing equity

- Self-construction contribution is valued and offsets loan requirements

- Government grants offset loan repayment

- Grants are fixed regardless of income/loan amount

- Members pay rent plus interest on the loan

- Favourable loan interest rate negotiated by FUCVAM

Housing Cooperative in Uruguay by FUCVAM